In my view, Capital Gain has more debatable issues than any other source of income under the Income Tax. Today in this article I have tried to explain one of its issue that is meaning of rural agricultural land

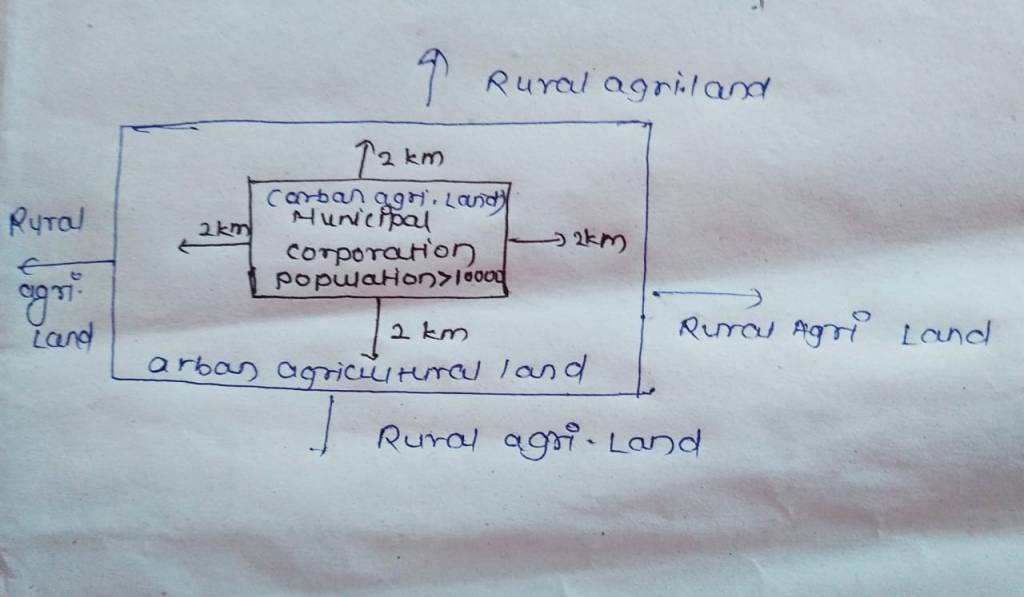

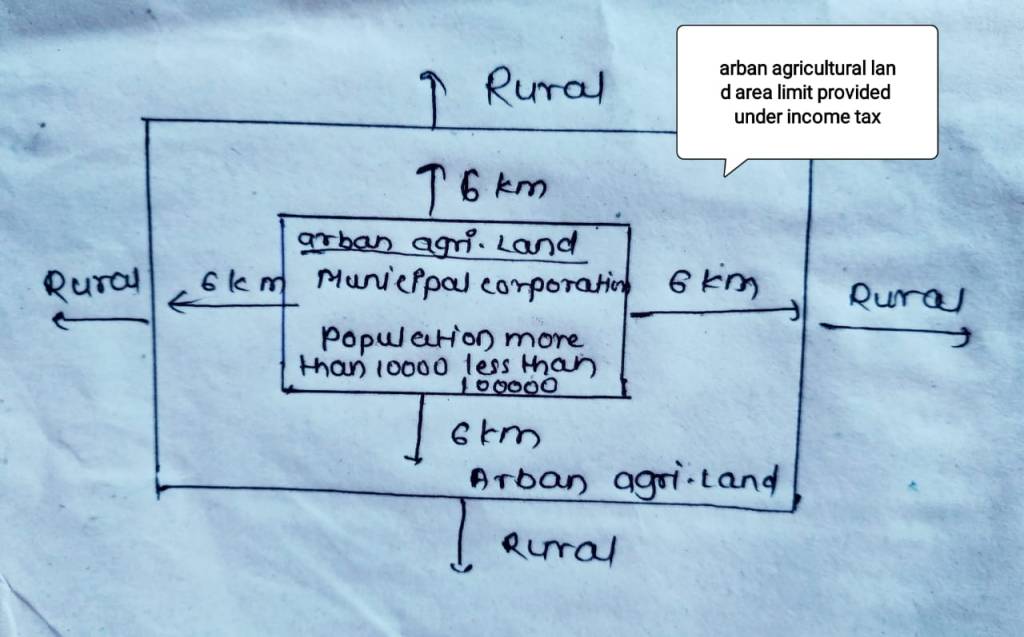

Indian government has developed the definition by providing areal distance limits

normally we thought that rural agricultural land means land in rural areas but here government defines the rural agricultural land according to population in that area

Any land which is not

(a) in any area which is comprised within the jurisdiction of a municipality(whether known as a municipality, municipal corporation) or a cantonment board and which has a population of not less than 10,000 or

(b) in any area within the distance, measured aerially,—

(I) not being more than two kilometres, from the local limits of any municipality or cantonment board referred to in item (a) and which has a population of more than 10,000 but not exceeding 1,00,000 ; or

(II) not being more than six kilometres, from the local limits of any municipality or cantonment board referred to in item (a) and which has a population of more than 1,00,000 but not exceeding ten lakh; or

(III) not being more than eight kilometres, from the local limits of any municipality or cantonment board referred to in item (a) and which has a population of more than ten lakh.

Explanation.—For the purposes of this sub-clause, “population” means the population according to the last preceding census of which the relevant figures have been published before the first day of the previous year;

🚨 Any land in area having population below 10000 it always treated as rural agricultural land

Under Income Tax Act Taxability under head Capital Gain does not arises on sale of rural agricultural land since Rural Area in India is not considered a capital assets