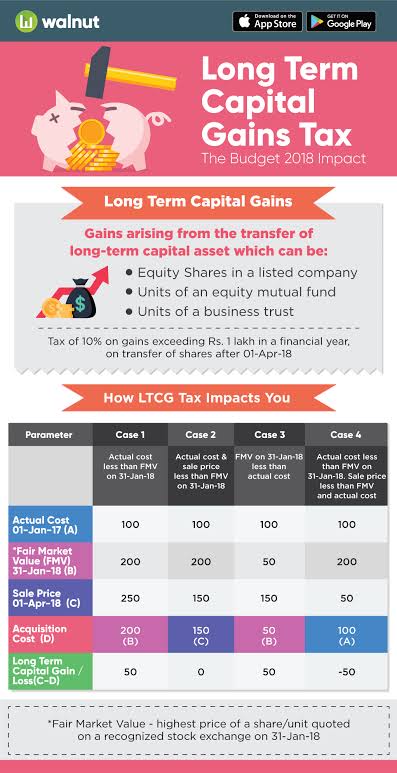

On sale of capital assets capital gain arises. Such Gain is classified in two categories namely

• Long Term Capital Gain

• Short Term Capital Gain

Lets understand rates of taxes under Capital gain

💡 Tax rates on Long Term Capital Gain

- If you are investing in unlisted shares or securities of company – @ 20% with benefit of indexation. (however if assessee is a NR – then tax liability in his hands @ 10% without availing benefit of indexation )

- If you are investing in listed shares or bonds – @10% without indexation or 20% with indexation at the option of assessee.

- If you are investing in

- Listed Equity Shares

- Equity oriented mutual fund or

- Unites of Business Trust

- And STT has been paid on such transaction at the time of sale and purchase

– Tax @ 10% on amount exceeding 100000

(No benefit of indexation and currency fluctuation is available)

According to my point of view investment in 3rd option is more beneficial though no other deductions are available for this option still it attracts lower rate of tax @10% under income tax further additional exemption of 100000 is also available.

*Here point to note down is no rebate is available against income

*deductions under section 80C to 80U only the deductions are not allowed that is other deductions are allowed