Do you know what is capital gain.. And if you are investing anywhere do you know that how it will make you liable to pay tax!! Lets 👀

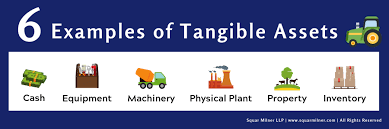

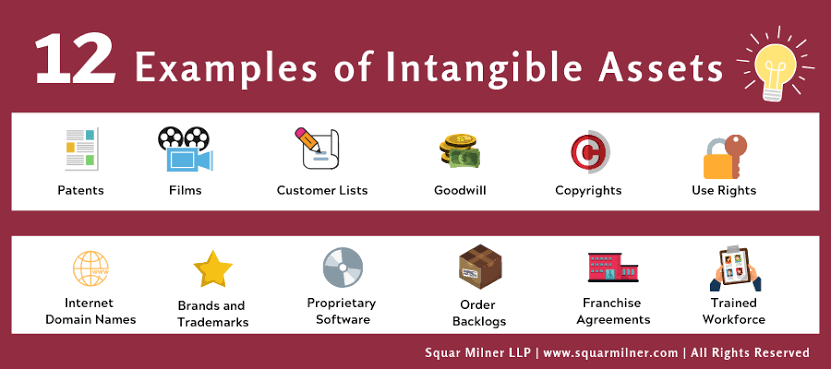

Capital asset means property of any kind connected to business or not connected to businessl whether tangible or intangible, Movable or immovable and

🚨 (“Do you know what is the difference between tangible and intangible and also the examples of it “)

And includes

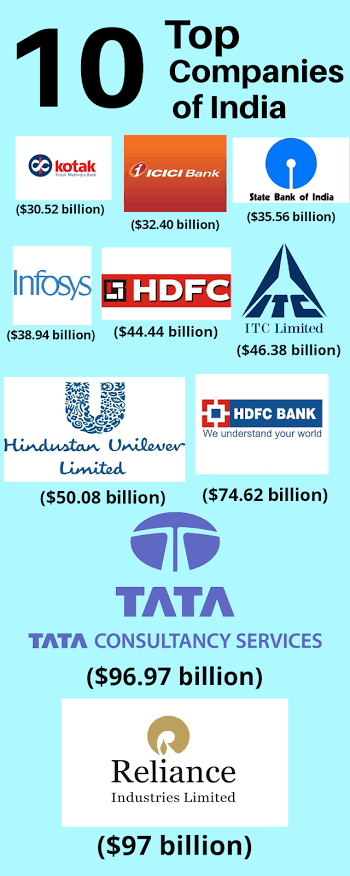

A ) any right of management or control whatsoever in Indian Company . refer Vodafone Case study given below as example for given point

B ) Securities held by foreign institutional investor

List of capital asset excludes :

a) stock in trade

b) personal effects

C) Rural agricultural land in India

d) Specified bonds

💡 From these you should know the meaning of personnel effect and rural agricultural land because our government made its definition very smartly ..

Will see this in next post in descriptive way.. Have a nice life journey with tax…

💐 Be a not only educated but also a intelligent educator.. 💐